MTA Queensland Federal Budget Brief 2019

Statistics

- Budget surplus $7.1 billion (total $45 billion over the next four years)

- Commonwealth debt eliminated by 2030

- Consumer Price Index per cent: 2 ¼ % forecast

- GDP: 2 ¾ %

- Unemployment rate: 5%

- Wage: 2 ¾ % forecast

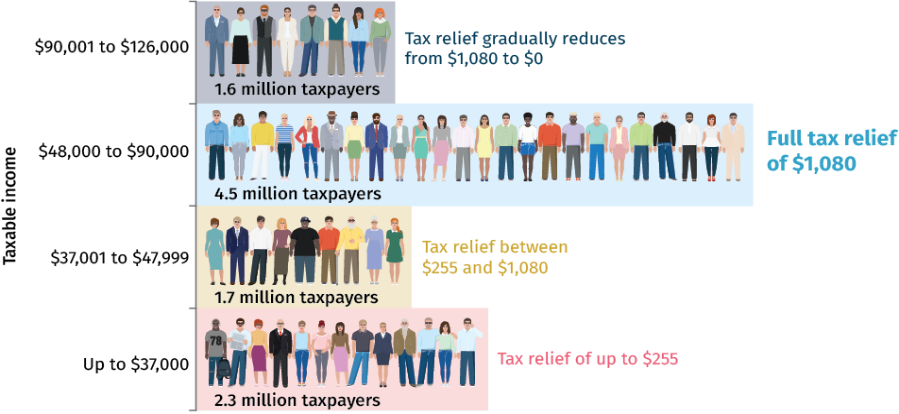

Personal income tax

- $158 billion in tax relief on top of the $144 billion in tax cuts locked into legislation last year.

Business /Small business

- The company tax rate for small and medium sized companies with annual turnover of less than $50 million has been lowered to 27.5 per cent. This rate will be lowered further to 25 per cent by 2021-22. Similar timing applies to the increases in the unincorporated small business tax discount rate, which will increase to 16 percent by 2021-22 (up to the cap of $1,000)

- The instant asset write-off threshold increased to $30,000 and expanding access to medium-sized businesses with annual turnover less than $50 million. These changes will apply from 7:30pm (AEDT) on 2 April 2019 to 30 June 2020. The threshold applies on a per asset basis so eligible businesses can instantly write off multiple assets.

Energy

- $1.4 billion equity injection commitment Snowy 2.0 project

- Partnering with the Tasmanian Government to accelerate the Battery of the Nation and Marinus Link projects by providing $56 million for the Marinus Link interconnector – a second electricity transmission connection between Tasmania and Victoria.

- A $13.5 million program to underwrite new generation investment. This will support increased competition in the National Electricity Market and help reduce wholesale electricity prices. A shortlist of 12 projects has been agreed to representing a combined capacity of 3,818 MW. This is equivalent to around seven per cent of the National Electricity Market

- $2 billion Climate Solutions Fund will help reduce greenhouse gas emissions.

- Priority Transmission Taskforce to support timely delivery of transmission projects from the Australian Energy Market Operator’s Integrated System Plan.

- $284 million for a one-off, income tax exempt payment to o assist with next power bills and cost of living expenses. The payment of $75 for singles and $125 for couples will be made to those eligible for certain social security payments.

- $8.4 million to help speed up gas supplies from the Northern Territory to the east coast market by opening up the Beetaloo sub-basin for exploration and development

Infrastructure

- $100 billion over the next decade

Skills & Training

- The Government is investing over $525 million to upgrade the VET sector

- A Delivering Skills for Today and Tomorrow package will:

- Create up to 80,000 additional apprentices in areas of priority skill shortage by investing $156.3 million in the new Additional Identified Skills Shortage payment

- Increase support provided to individuals with low levels of education attainment to gain skills they need to secure jobs now and into the future. We are committing $62.4 million to this programme, including four pilots in remote communities

- Address youth unemployment by providing 400 vocational education and training scholarships, in selected Australian regions, to support young Australians gain the skills they need to secure ongoing employment ($8.2 million)

- Improve career advice to young Australians and workers transitioning careers by establishing a $32.4 million National Careers Institute and appointing a National Careers Ambassador

- Develop skills in areas of need by building innovative partnerships between schools, employers and the VET sector through a new $10 million competitive grants programme

- Promote a nation-wide approach to skills development and enhance the role of industry in designing training courses by providing $90 million to fund a National Skills Commission and piloting Skills Organisations across the country in the key areas of human services care and digital technologies, including cyber security

- Provide greater job opportunities for young people in regions with high youth unemployment by funding $50.6 million towards Industry Training Hubs to create better linkages between schools and local industry

- Streamline incentives for employers of apprentices and trainees and modernise the skills need list through an investment of $44 million

Automotive Taxation

- LCT : $640 million (down $80 million on MYEFO estimates)

- Custom duty: $21.1 billion

- Fuels excise: $20.5 billion

Banks

- Provision of more than $640 million to help restore trust in the financial sector, including:

- over $400 million to ASIC to support its new enforcement and supervisory strategies and expanded remit

- over $150 million to APRA to strengthen supervision and enforcement

- over $35 million for a new criminal jurisdiction of the Federal Court.