JobKeeper

Key Dates and Information about JobKeeper payments

The first two JobKeeper fortnights are:

- Fortnight 1 – 30 March -12 April

- Fortnight 2 – 13 April – 26 April

To claim the JobKeeper payment, businesses must pay eligible employees a minimum of $1500 (before tax) for fortnight 1 and 2 before 8 May.

The following ATO online forms must also be completed:

- Step 1 – Enrol – for JobKeeper fortnights 1 and 2 (and May fortnights). Enrolment is open now and you must enrol before 31 May.

- Step 2 – Identify – available from 4 May once you are successfully enrolled and must be completed before 31 May. You will need to identify the eligible employees and/or the business participant for who you are claiming the JobKeeper wage subsidy.

- Step 3 – Monthly Declaration – confirm your eligible employees have been paid and your turnover before 31 May.

To claim the JobKeeper Payment, an employer must receive a completed eligible employee nomination form for each eligible employee and/or the nomination form for the business participant before steps 2 and 3 are completed.

You may decide to confirm employee eligibility prior to paying your employees and may request and complete the eligible employee nomination form prior to the time that you complete steps 2 and 3.

For more specific and up to date information on how to enrol, identify and declare, and key dates, please see the How to Guides on the ATO website.

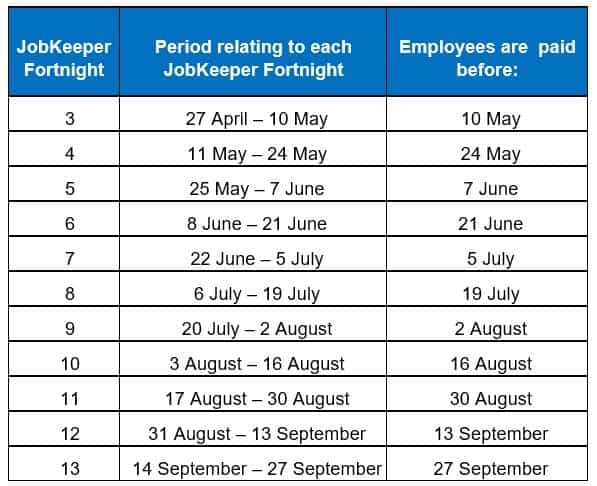

The payment dates for all following JobKeeper fortnights are:

JobKeeper Update

Enrolments for the JobKeeper Payment opened last week, with more than 400,000 businesses employing 2.4 million employees already signing-up.

To ensure the integrity and the efficient operation of the JobKeeper Payment, the Government has made numerous clarifications on the rules for the payment, including the following:

- An alternate decline in turnover test will be used to address the circumstances where business structures use a special purpose entity to employ staff rather than staff being directly employed by an operating entity.

- Charities may elect to exclude any government revenue from the JobKeeper turnover test, helping to ensure that any charity that delivers significant services that are funded by the government are not adversely affected.

- Any employer who has enrolled in the JobKeeper Payment must ensure that all eligible employees who have agreed to be nominated by the employer are covered by the scheme. Employers must abide by a ‘one in, all in’ principle, and may not choose which employees are or are not given access to the payment.

- Full time students aged 16 and 17 years old may be eligible for the JobKeeper Payment only if they are financially independent and require the security provided by participation in the scheme. Any full time student aged 17 years of younger who is not financially independent will not be eligible for the JobKeeper Payment. However, this clarification will be applied prospectively, meaning any eligible employer that has met the wage condition of paying such an employee $1,500 for a fortnight could be entitled to a JobKeeper Payment in arrears for that fortnight.

To find out more about the rule clarifications for the JobKeeper payment click here.

Bridging Funding for JobKeeper

Australian banks are playing a vitally important role in bridging the finance that businesses need to pay their staff ahead of receiving the first JobKeeper Payment in the first week of May.

It is an integrity measure that businesses pay their staff before receiving the JobKeeper Payment.

On 23 April 2020, the Treasurer announced the CBA, NAB, Westpac and ANZ banks agreed to establish dedicated hotlines for their customers to call to receive the bridging finance necessary to pay their staff ahead of receiving the JobKeeper Payment.

The hotlines are as follows:

- CBA: 13 26 07

- ANZ: 1800 571 123

- NAB: 1800 JOBKEEPER

- Westpac: 1300 731 073 and Westpac’s subsidiaries;

- St George: 1300 730 196

- Bank of Melbourne: 1300 784 873

- Bank SA: 1300 669 472

The banks have also agreed to bring to the front of the queue all bridging finance applications.

This means any business that is eligible for the JobKeeper Payment can now ring the dedicated hotline for the bank and ask for the bridging finance necessary to pay their staff. The banks know their customers. They know these businesses. The banks need to stand by these businesses in their time of greatest need and that is now.

The ATO have also set out detailed guidance on eligibility and enrolment for the JobKeeper Payment, which can be found here: https://www.ato.gov.au/General/JobKeeper-Payment/

JobKeeper Alternative Decline in Turnover Test Rules

The ATO released the Coronavirus Economic Response Package (Payments and Benefits) Alternative Decline in Turnover Test Rules 2020 on 23/04/2020. The legislation provides alternative bases for a business to satisfy the decline in turnover test for the purposes of seeking to be a qualifying employer for JobKeeper payments when there is not an appropriate relevant comparison period.

JobKeeper payment – employee nomination notice

The ATO has released the employee nomination form for the JobKeeper payment.

This form has two purposes:

- It informs the employee of the employers intention to enrol in the JobKeeper scheme; and

- It seeks the employees agreement to be nominated.

This form must be provided to the employee to be signed and returned to the employer. It is not required to be lodged with the ATO.

The JobKeeper payment employee nomination notice can be found here: https://www.ato.gov.au/Forms/JobKeeper-payment—employee-nomination-notice/

Fair Work Commission Advice

The Fair Work Commission has released helpful information on:

JobKeeper Disputes – The Fair Work Act 2009 has been varied to insert a new Part 6-4C to help employers who qualify for the JobKeeper payment to deal with the economic impact of the coronavirus (COVID-19).

JobKeeper enabling directions and agreements – Part 6-4C of the Fair Work Act allows an employer who is entitled to the JobKeeper payment in relation to a particular employee to give a temporary ‘JobKeeper enabling direction’ to that employee.

JobKeeper Update

Please find below documents that were released / updated over the Easter long-weekend:

- The JobKeeper rules and the associated explanatory statement, dated 9 April 2020; and

- The updated fact sheet and FAQs issued by the government, dated 11 April 2020.

KPMG have also produced a JobKeeper Summary on 8 April 2020 which is consistent with the final form of the JobKeeper rules.

Important notes include:

- When determining whether the employing entity needs to demonstrate a 30% or 50% reduction in turnover to qualify for the program, this is assessed by reference to “aggregated turnover”. This is an income tax concept, and broadly means the total business income of the employing entity and all of its affiliates and connected entities throughout the world. Where this aggregated global turnover exceeds $1 billion per year, the entity will need to show a 50% decline in revenue. As expressed in the explanatory statement (page 7), “in this way, a small business that forms part of a group that is a large business must have a 50% decline in turnover to satisfy the test”.

- To become eligible for JobKeeper payments, the employing entity then needs to satisfy the decline in turnover test. This test can be satisfied by passing either the basic or alternative turnover test, as discussed below. Interestingly, as expressed in the explanatory statement (page 6), “the decline in turnover test needs to be satisfied before an entity becomes eligible for the JobKeeper payment… once this occurs there is no requirement to retest in later months”. The explanatory statement goes on to say that “if an entity does not qualify for the month of April 2020 because its turnover has not been sufficient affected, it can test in later months to determine if the test is met”.

- The basic decline in turnover test works by comparing the projected GST turnover of the entity for a period with its current GST turnover as calculated for a relevant comparison period. As expressed in the explanatory statement (page 6), “in effect this compares a month or quarter in the period the JobKeeper scheme applies with the corresponding period in 2019”. The relevant periods that can be tested include any month between March 2020 and September 2020 (inclusive), or the quarters ending 30 June 2020 or 30 September 2020. It appears that satisfying this test for the period of March 2020 should therefore qualify an entity for the entire six month program.

- The alternative decline in turnover test applies if there is “not an appropriate relevant comparison period in 2019”. The examples provided in the explanatory statement (pages 9-11) include instances where the entity is a new business, the entity made a major business acquisition in early 2020, a farming business impacted by major drought in 2019, and other instances where “the basic test may not accurately reflect the downturn in activity that the business has suffered”. In these instances, the Commissioner may determine an alternative decline in turnover test applies to a class of entities. We are hoping to see a range of other circumstances covered by alternative tests.

- A focus of the coming days will likely be on issues such as how to formally register for the program (noting entities should already have informally registered here), and how the program is administered in practice both from an ATO and employer perspective. There is some guidance in the attached documents on some issues. Of particular interest here may be the frequently asked questions (pages 1-6) and the explanatory statement (pages 12-21). We are expecting more detailed guidance from the ATO in the coming days, including details on the initial formal registration process and how the program will interact with existing single touch payroll systems.

More information about the JobKeeper Payment for employers can be found here: https://treasury.gov.au/coronavirus